OTA Market Analysis: What Income Statements Reveal About Competitive Strategy

AI Content Disclaimer: Mostly human, with some AI-assisted tweaks

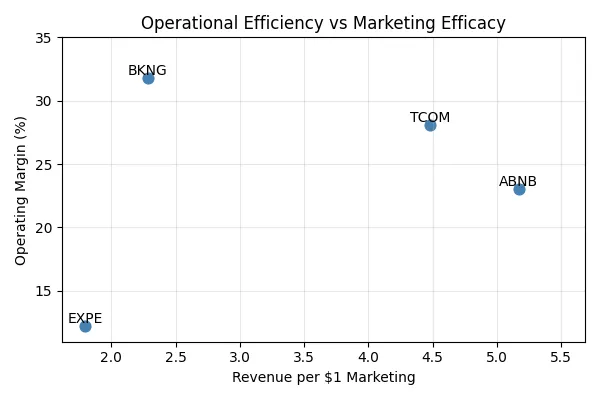

The scatter plot contains Airbnb (ABNB), Bookings Holdings (BKNG), Trip (TCOM), Expedia (EXPE) for a broad snapshot of the OTA market. Looking at this competitive landscape reveals four distinct strategic positions, each reflecting different market dynamics and business maturity:

BKNG: Profitable, Market Leader

Position: High operational efficiency (~32% margin), moderate marketing ROI ($2.3 per dollar)

Strategic Profile: Classic mature market leader prioritizing profitability over growth. Its operational excellence reflects years of optimization, while lower marketing returns indicate they’ve captured most accessible customers in saturated markets.

Competitive Advantage: Sustainable profit generation and operational discipline position them well for economic downturns but may limit growth upside.

TCOM: In the Sweet Spot

Position: Strong operational efficiency (~28.5% margin), high marketing ROI ($4.5 per dollar)

Strategic Profile: Optimal positioning suggesting dominance in less saturated markets (primarily Asia-Pacific) where they can maintain both scale efficiency and find high-return growth opportunities.

Competitive Advantage: Best of both worlds - they haven’t yet hit the diminishing returns that plague mature Western markets, indicating significant room for profitable expansion.

ABNB: Still Growing

Position: Moderate operational efficiency (~23% margin), highest marketing ROI ($5.1 per dollar)

Strategic Profile: Still in expansion mode, prioritizing market share capture over margin optimization. High marketing returns suggest they’re successfully penetrating new customer segments and geographies.

Strategic Opportunity: Room for operational improvement as they scale, with the potential to move toward TCOM’s position as they mature.

EXPE: Struggling by comparison

Position: Low operational efficiency (~12.5% margin), lowest marketing ROI ($1.8 per dollar)

Strategic Challenge: Caught in the worst position - unable to achieve operational scale like BKNG while also failing to generate strong marketing returns like ABNB. This suggests fundamental competitive disadvantages.

Market Reality: Appears squeezed between more efficient operators and more dynamic growth players, potentially lacking clear differentiation in an increasingly commoditized segment.

Industry Implications

What gets missed in the myopic BvP comparisons is context and rich insights. The positioning reveals a bifurcated market where geography and timing matter significantly.

-

BKNG’s less-than-efficient ROI can be attributed to a saturated market. Without new segments or categories to capture, the increased acquisition costs are expected.

-

It’s offsetting those costs by streamlining operations.

Not considering operations alone is a HUGE reason why most BvP arguments are trash.

-

ABNB presumably hit a ceiling as well, and is growing other markets/categories.

-

Homeownership rates in the U.S. are at its lowest since 2019 (FRED is your friend).

-

The percentage of homeowners that actually host an Airbnb is considerably low.

-

The CEO, Brian Chesky stated in the last earnings call that Airbnb is yet to reach certain demographics, and is underpenetrated in the Midwest.

-

TCOM benefits from operating in less mature markets, while BKNG has maximized efficiency in saturated ones.

Is there a conclusion?

In general no. Nothing here is a definitive indicator that brand is better than performance or vice versa. Comprehensive studies like Les Binet and Peter Field’s “The Long and the Short of It” that track results over time have already answered that question.

Several factors both quantitative and qualitative contribute to stock prices. Trying to find a correlation between marketing strategy and the stock price feels like it’s skipping a lot of steps, but I don’t claim to know everything.

Link to Github repo for this script

Maybe you can spot something I didn’t.